Types of Benefits

Workers’ Compensation began in New Jersey in 1911. It was created to safeguard workers’ rights after an injury. Prior to that, workers who were injured on the job had to endure a long and rocky road to be compensated for their injuries. They were forced to file a lawsuit against their employer for carelessness and negligence, all the while struggling to pay their bills as they recovered.

Workers’ Compensation began in New Jersey in 1911. It was created to safeguard workers’ rights after an injury. Prior to that, workers who were injured on the job had to endure a long and rocky road to be compensated for their injuries. They were forced to file a lawsuit against their employer for carelessness and negligence, all the while struggling to pay their bills as they recovered.

It was a long process, during which they had no medical benefits or income. And since the law gave more power to employers, workers often lost their cases.

Today, the New Jersey Workers’ Compensation Act protects workers with temporary disability benefits and medical care, and offers an award for permanent disability. Injured workers who build a strong case do not have to worry about staying afloat financially as they strive to recover from their injuries. That means they can channel all of their energy into getting well.

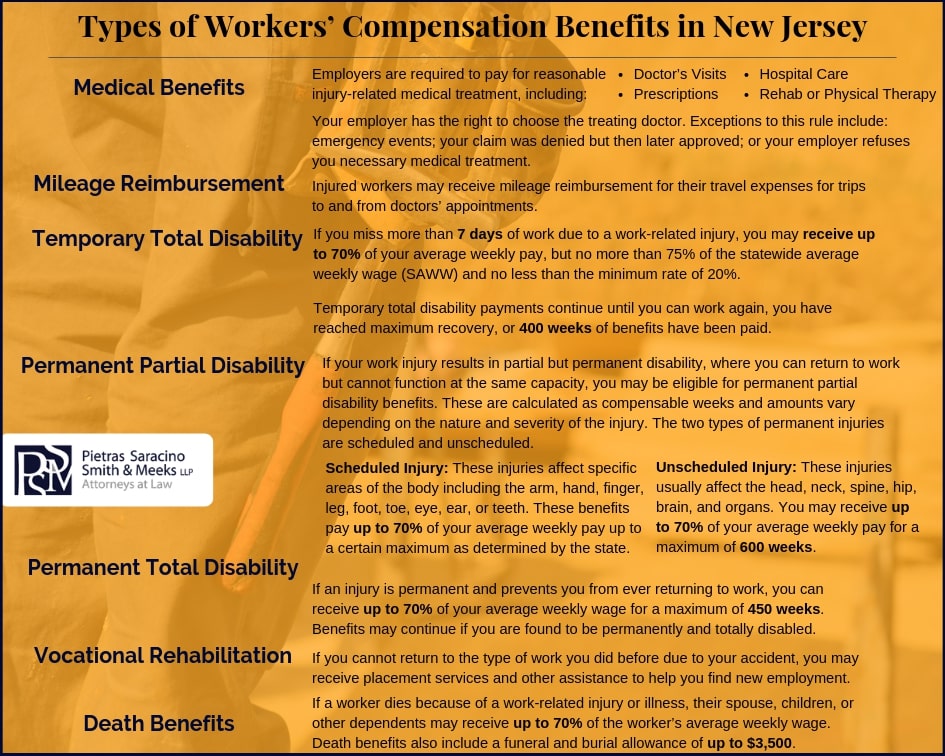

These are the benefits you may be entitled to:

Medical: Your medical benefits should cover all necessary and reasonable medical care and treatment, any medications, and hospitalization costs. Remember that you must keep your employer apprised of your care and treatment, and you should document all of it.

Temporary Total Disability: If you are disabled for more than seven days, you are eligible for this benefit. It is calculated at 70 percent of your average weekly wage, but it cannot exceed 75 percent of the Statewide Average Weekly Wage (SAWW), or fall below the minimum SAWW of 20 percent. These benefits apply only when you are unable to work, and you are under active medical care.

Permanent Partial Disability: When your workplace injury results in a partial but permanent disability, your benefit will be based on a percentage of certain scheduled (specific) or non-scheduled losses.

For example, a specific loss may involve arms, hands, fingers, legs, feet, toes, eyes, ears, or teeth. A non-scheduled loss involves any area or body system that is not specifically identified in Workers’ Compensation charts. This may include the back, heart, and lungs. Permanent partial disability benefits are paid weekly, and they are due after the temporary disability ends.

Permanent Total Disability: When an injury is permanent and prevents you from returning to gainful employment, you are entitled to permanent total benefits, which last for 450 weeks. After that, if you can prove that your injury is permanent, your benefits will continue.

This benefit is calculated at 70 percent of your average weekly wage, not to exceed 75 percent of the SAWW or fall below 20 percent of the SAWW. This benefit is paid weekly.

Death Benefits: If your loved one died as a result of work-related injuries, that person’s survivors may be entitled to benefits. Benefits, which are paid weekly, are 70 percent of the deceased worker’s weekly wage, with limitations. The benefit amount is divided by surviving dependents as determined by a judge after the extent of dependency is decided.

In some cases, actual dependency must be proved. Dependent children can receive benefits until age 18, or until age 23 if they are full-time students. Physically or mentally disabled children may be eligible for additional benefits.

Funeral expenses: If an employee is killed at work, their family members are entitled to funeral and burial expenses up to $3500.

Mileage reimbursement: Workers’ Compensation covers your mileage for back and forth travel from doctors’ appointments.

Vocational rehabilitation: If you are unable to return to the type of work you did because of your accident, you are entitled to placement services and other assistance in finding new employment.

What if your employer is uninsured?

If you are injured while working for an uninsured employer, you are still eligible for benefits. You can apply to the Division’s Unemployed Insurers Fund.

Our Workers’ Compensation Lawyers in Cherry Hill Will Ensure You Get the Benefits You Deserve

The Workers’ Compensation process can be complex and confusing, and if the rules are not followed properly, you could risk your claim. Our Workers’ Compensation attorneys in Cherry Hill will help guide you and build a strong case so that your rights are upheld and so that you receive the maximum possible benefits. We can also handle any third-party claims. To learn more, please call 856-761-3773 or contact us online for a free evaluation of your case. Our office is centrally located in Cherry Hill, and we serve clients throughout New Jersey.